Voice Automation Solutions

Payment Processing

Secure Payments over the Phone

Process Payments Via Phone

Give customers a secure, easy-to-use method to pay their bills. Integrate an interactive voice response (IVR) system with a payment processing application to give customers a convenient and flexible way to pay their bills over the phone. Eliminate the need for an Internet connection or mail service delivery to get payments delivered. Complete transactions securely, faster and more efficiently than traditional methods.

Benefits of Phone Payment Processing

COMPLIANCE AND OVERSIGHT

Plum Voice has undergone rigorous audits to achieve PCI-DSS, SOC2 and HIPAA compliance and is a Visa Verified vendor.

API INTEGRATIONS

Use APIs to integrate Plum Voice tools with most payment gateways to save time, money and resources.

PAYMENT GATEWAY OPTIONS

Have the flexibility to switch gateways as needed.

SCALABLE PLATFORM

Scale automatically to handle an increase or decrease in call volume from natural growth, holiday, promos or call spikes.

DEPENDABLE INFRASTRUCTURE

The Plum Voice cloud infrastructure resides in physically secured, geographically dispersed, Class A data centers that are fed by Tier 1 redundant telecom connections.

OPERATIONAL COST SAVINGS

An IVR system is less expensive than employing live agents for simple, repetitive payment processes.

REDUCE RISK OF FRAUD

Virtual agents are a safer and more reliable alternative to live agents manually processing payments.

Make payment processing secure, fast and easy.

Build an IVR Application Today

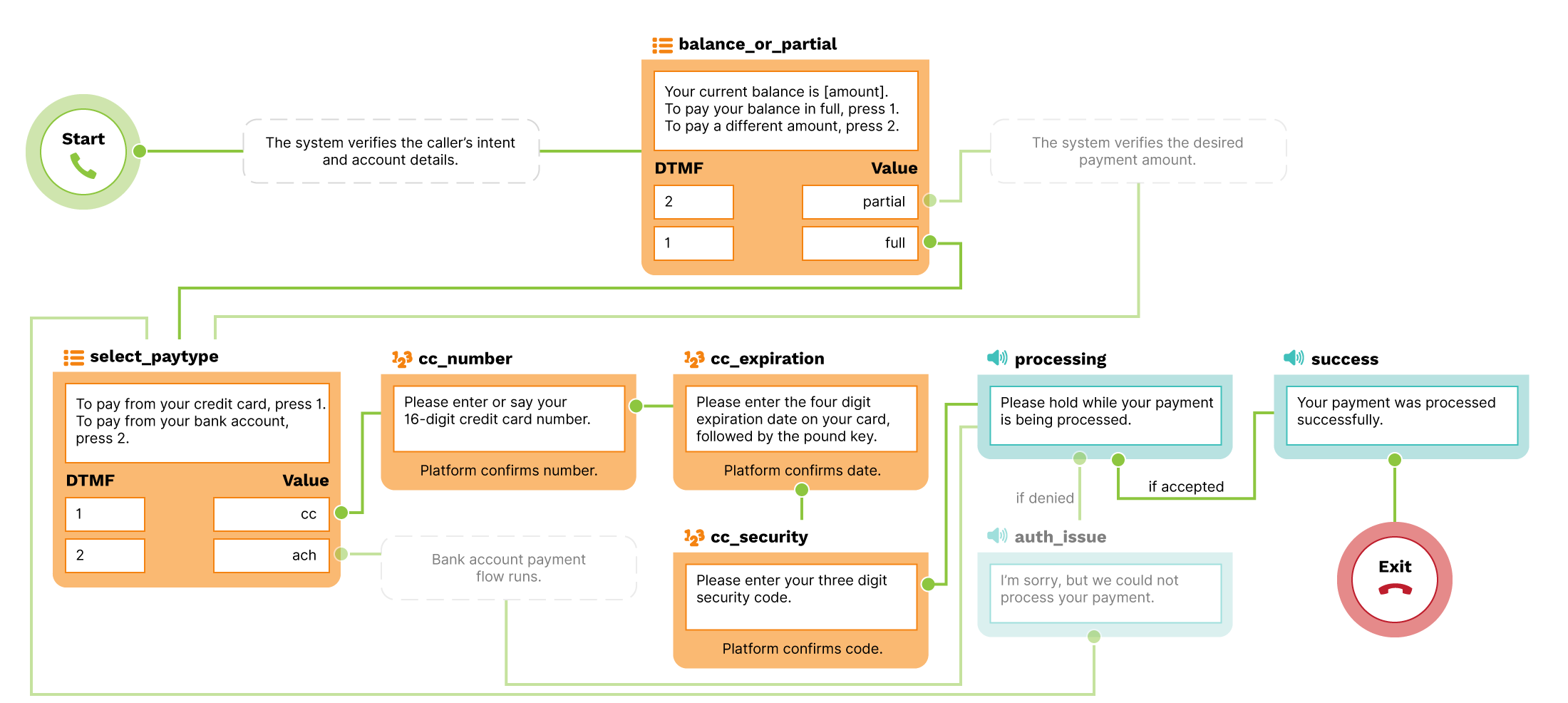

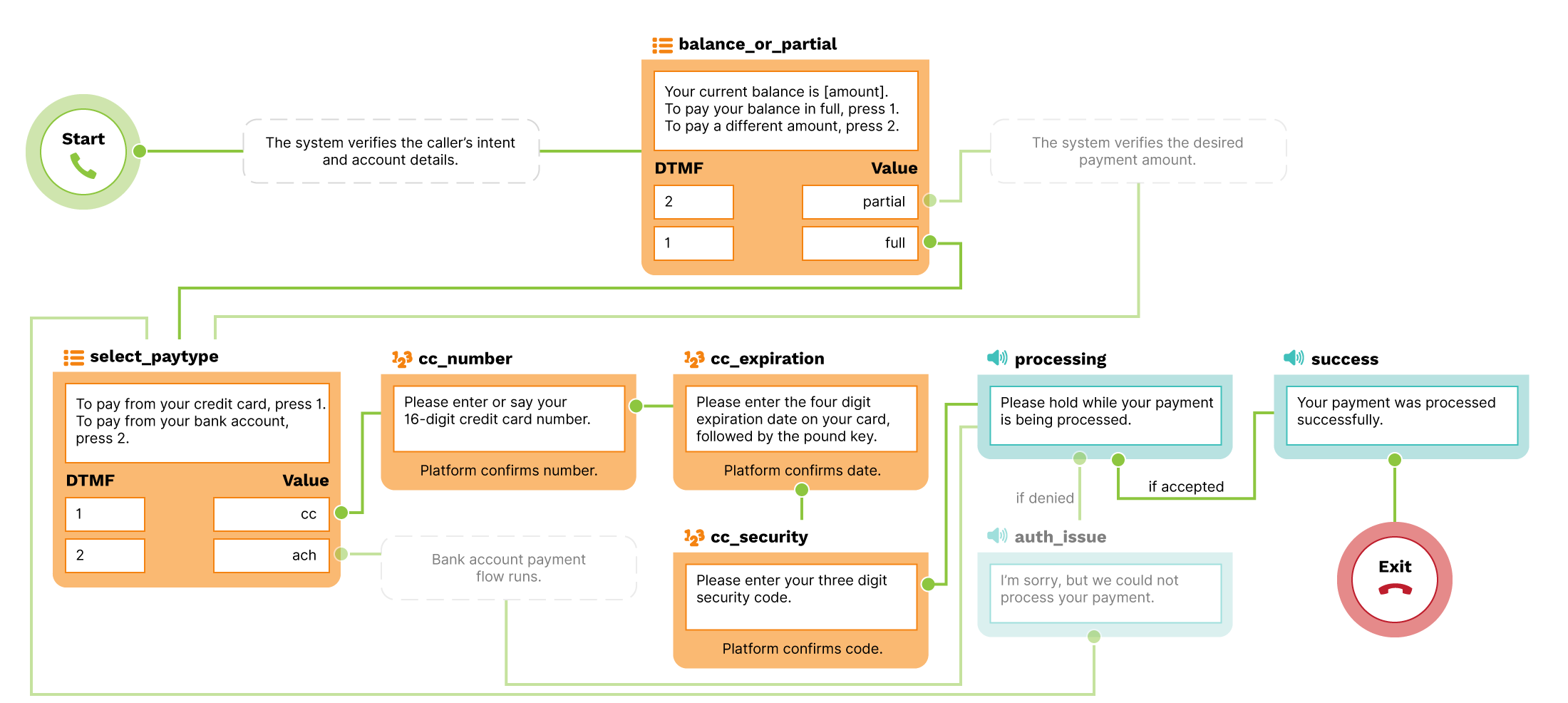

Plum Voice makes it simple to build voice-automated applications, including interactive voice response (IVR) systems, on a secure and scalable platform with the Plum Fuse tool and pre-built templates. Here's an abbreviated example of an payment processing template:

Build Self-Service Solutions with Plum Voice

Developers can design, build and deploy a custom solution in days, not weeks!

- Plum DEV and Plum Fuse tools complement and support each other - code in VXML and then manage with a low-code GUI tool - for an agile and flexible experience.

- Prebuilt application templates are available in the Fuse Template Center.

- Connect thousands of data sources through APIs to provide real-time information.

- Plum Chat (chatbot tool) and Plum Message (enterprise-level campaign management platform) enable you to communicate with customers more efficiently and effectively.

- Our Professional Services team can assist throughout the entire development process.

Fuse

Templates

- Fiserv CardConnect Payment Processing

- Payment Application

- Payment Reminder

EASY API INTEGRATIONS ■ REAL-TIME INFORMATION ■ ON-DEMAND AVAILABILITY ■ SCALABILITY ■ SECURE PLATFORM

5 Benefits of Using Plum Voice Tools

Why use the Plum Voice toolkit that lives on a secure and scalable platform?

- First Call Resolution

- Become More Efficient

- Task Your Staff Effectively

- Reduce Operational Costs

- Secure and Agile Cloud Platform